Dieppe, New Brunswick--(Newsfile Corp. - September 6, 2024) - Colibri Resource Corporation (TSXV: CBI) ("Colibri" or the "Company") is pleased to announce that, further to its news release of August 23, 2024, it has closed the first tranche of its previously announced non-brokered private placement (the "Offering") of units ("Units") for aggregate gross proceeds of $305,500. Each Unit consists of one (1) common share (a "Common Share") and one (1) common share purchase warrant (the Warrants) of the Company. Each Warrant entitles the holder to acquire one additional Common Share of the Company at a price of C$0.075 for a period of 24 months following issuance.

Certain insiders of the Company have acquired an aggregate of 550,000 Units in the Offering for gross proceeds of $27,500. Participation by insiders in the private placement constitutes a related party transaction as defined under Multilateral Instrument 61-101, Protection of Minority Security Holders in Special Transactions. This participation is exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 as neither the fair market value of the units subscribed for by the insiders, nor the consideration for the units paid by such insiders, exceeds 25% of the Company's market capitalization.

The Common Shares and Warrants are subject to a statutory hold period expiring on the date that is four months and one day after closing.

The Company anticipates completing a second tranche of the Offering within the next few weeks.

The Offering, including the terms of the Offering, received the conditional approval of the Exchange prior to closing but is subject to the final approval of the Exchange. The net proceeds of the offering will be used for exploration expenses at the Company's highly prospective precious metals projects in Mexico, including the Pilar gold project and the EP gold project as well as for working capital.

The Company also wishes to announce that it has sold its RC Drill Rig to a private company in Hermosillo Mexico for a total consideration of USD $395,000 which consisted of cash and drill credits. A portion of the proceeds is expected to be applied to an upcoming drilling program at the EP Gold Project where the Company intends to complete its first drilling program at the high priority San Perfecto target.

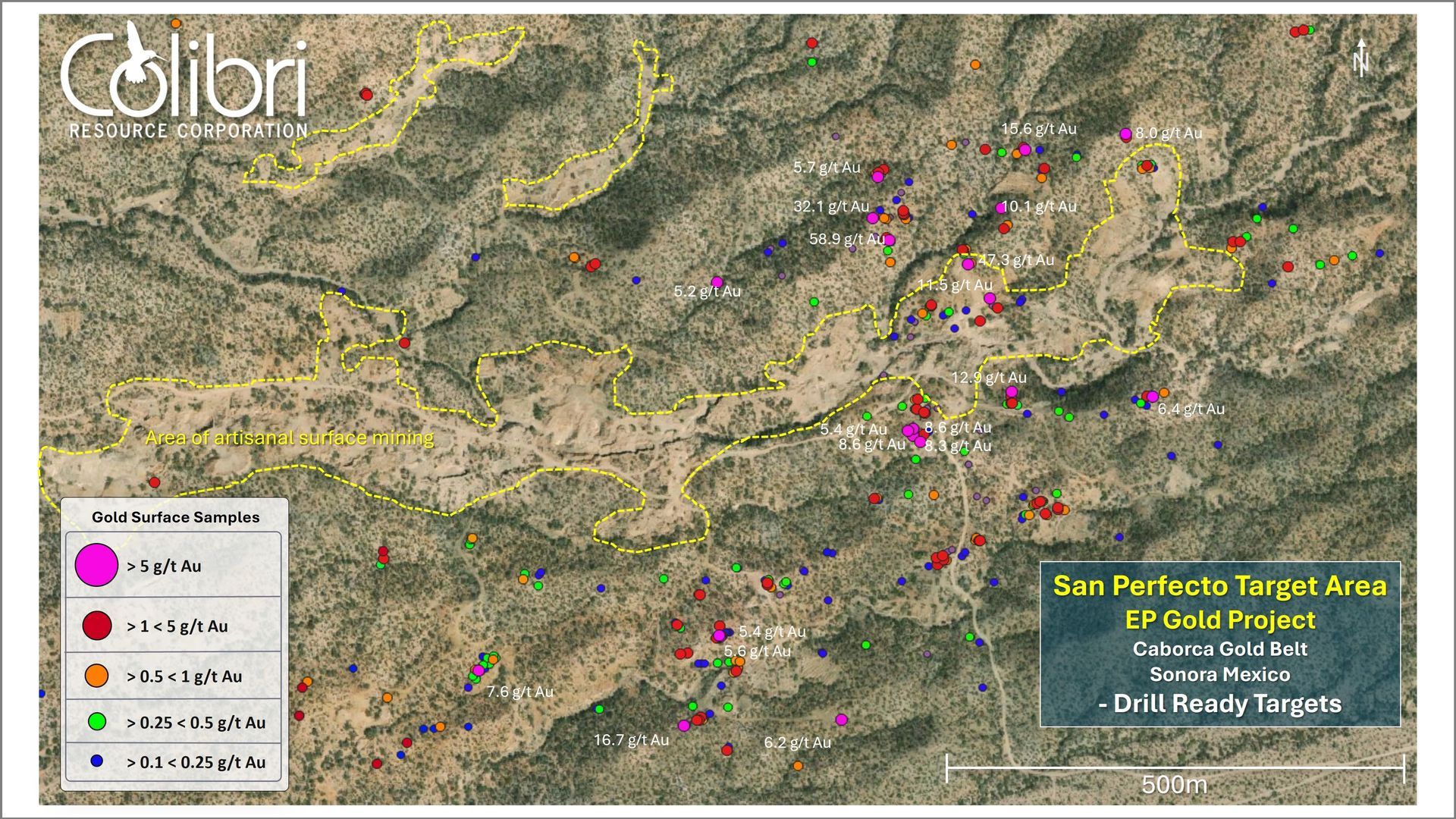

The San Perfecto target area is characterized by variably to strongly altered volcanic and intrusive rocks and has a mineralized footprint of approximately 1,250m by 700m which remains open to the southeast. A total of 616 samples are reported from the San Perfecto target surface area (102 by Colibri and 514 historical) of which 315, approximately 50 per cent, have returned values greater than 0.10 g/t Au and 213, approximately 35 per cent, have returned assay values greater than 0.25 g/t Au. Ninety-one samples (approximately 15 per cent of the total) have returned Au assays greater than 1.00 g/t with the highest grades, up to 58.9 g/t Au being associated with strong silicification and veins in faults zones.

A number of historical (artisanal) pits have been developed in the San Perfecto area including a larger production pit with a surface opening approximately of 35 m by 30 m. Only two exploration holes have been historically drilled in the area and both intersected significant mineralization.

Supported by interpretation of magnetic and IP data sets, the Company has interpreted the San Perfecto area as being indicative of a well-developed, high-level orogenic gold system with the potential to host economically significant mineralization.

QUALIFIED PERSON

Jamie Lavigne, P. Geo and a Director for Colibri is a Qualified Person as defined in NI 43-101 and has reviewed and approved the technical information in this press release.

The securities of the Company in this Offering have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the "U.S. Securities Act") or any U.S. state securities laws and may not be offered or sold in the United States absent registration or an available exemption from the registration requirement of the U.S. Securities Act and applicable U.S. state securities laws. This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful.

ABOUT COLIBRI RESOURCE CORPORATION:

Colibri is a Canadian-based mineral exploration company listed on the TSX-V (CBI) and is focused on acquiring, exploring, and developing prospective gold & silver properties in Mexico. The Company holds four high potential precious metal projects: 1) 100% of EP Gold Project in the significant Caborca Gold Belt which has delivered highly encouraging exploration results and is surround by Mexico's second largest major producer of gold on four sides, 2) 49% Ownership of the Pilar Gold & Silver Project which is believed to hold the potential to be a near term producing mine, and 3) two highly prospective interests in the Sierra Madre (Diamante Gold & Silver Project and Jackie Gold & Silver Project).

For more information about all Company projects please visit: www.colibriresource.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Notice Regarding Forward-Looking Statements:

This news release contains "forward-looking statements". Statements in this press release which are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, expectations or intentions regarding the future. Actual results could differ from those projected in any forward-looking statements due to numerous factors. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forwardlooking statements. Although the Company believes that the plans, expectations and intentions contained in this press release are reasonable, there can be no assurance that they will prove to be accurate.

For information contact:

Ian McGavney

President, CEO and Director

Tel: (506) 383-4274

Related news releases.