NEWS RELEASE - Dieppe, NB., March 21st, 2023 - Colibri Resource Corporation (TSX.V:CBI) (OTC:CRUCF) ("Colibri" or the "Company"), provides additional details of terms to acquire the Plomo Gold Project and further background as a follow up to its release of March 16, 2023.

Overview of Plomo Gold Project

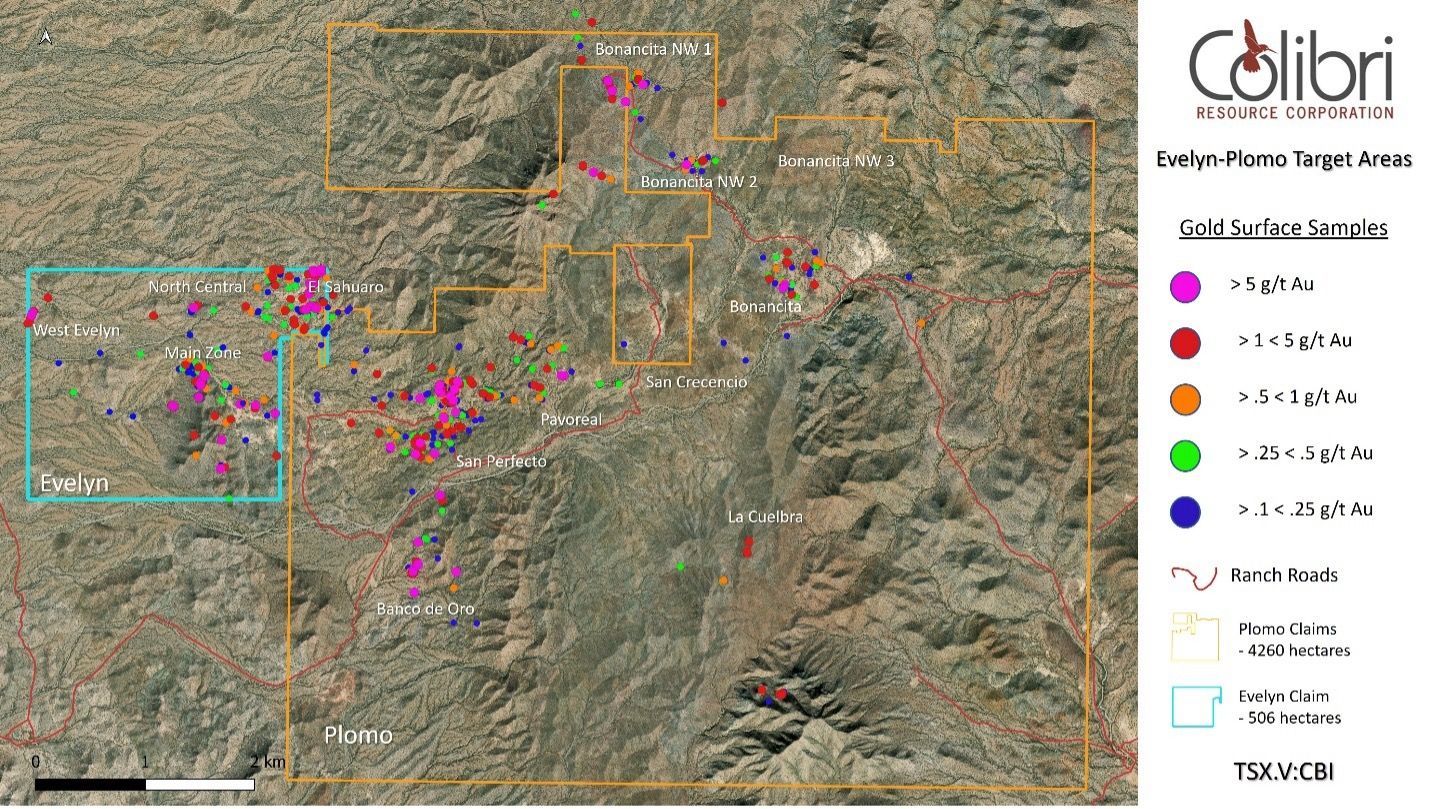

The Plomo property covers an area of approximately 4,260 hectares (“Ha”) and is contiguous with the Company’s Evelyn Property. The additional land increases Colibri’s area footprint by 842% to a total of 4,766 hectares.

The current database includes 1,853 surface rock samples of which 132 samples are greater than 1.0 g/t Au, 15 high grade samples are greater than 10 g/t Au and 524 samples are greater than 0.1 grams per tonne (“g/t”) Au. Surface exploration included prospecting, a 14.1 line Km 3D induced polarization study, mapping, and rock sampling. To date, 9 target areas have been identified on the Plomo property. (See: Figure 2 below).

Underground sampling completed in the adit at the Banco de Oro prospect in 2008 is reported to have included 298.0 g/t Au over a chip length of 2.4 metres

The Plomo property has been subject to only very limited exploration drilling, which was very early on in its exploration, with a total of 1,570 meters completed in 10 holes. A highlight of the drilling is the intercept of 0.66 g/t Au over an intersection length of 11.65 metres (“m”) completed in the San Perfecto target area.

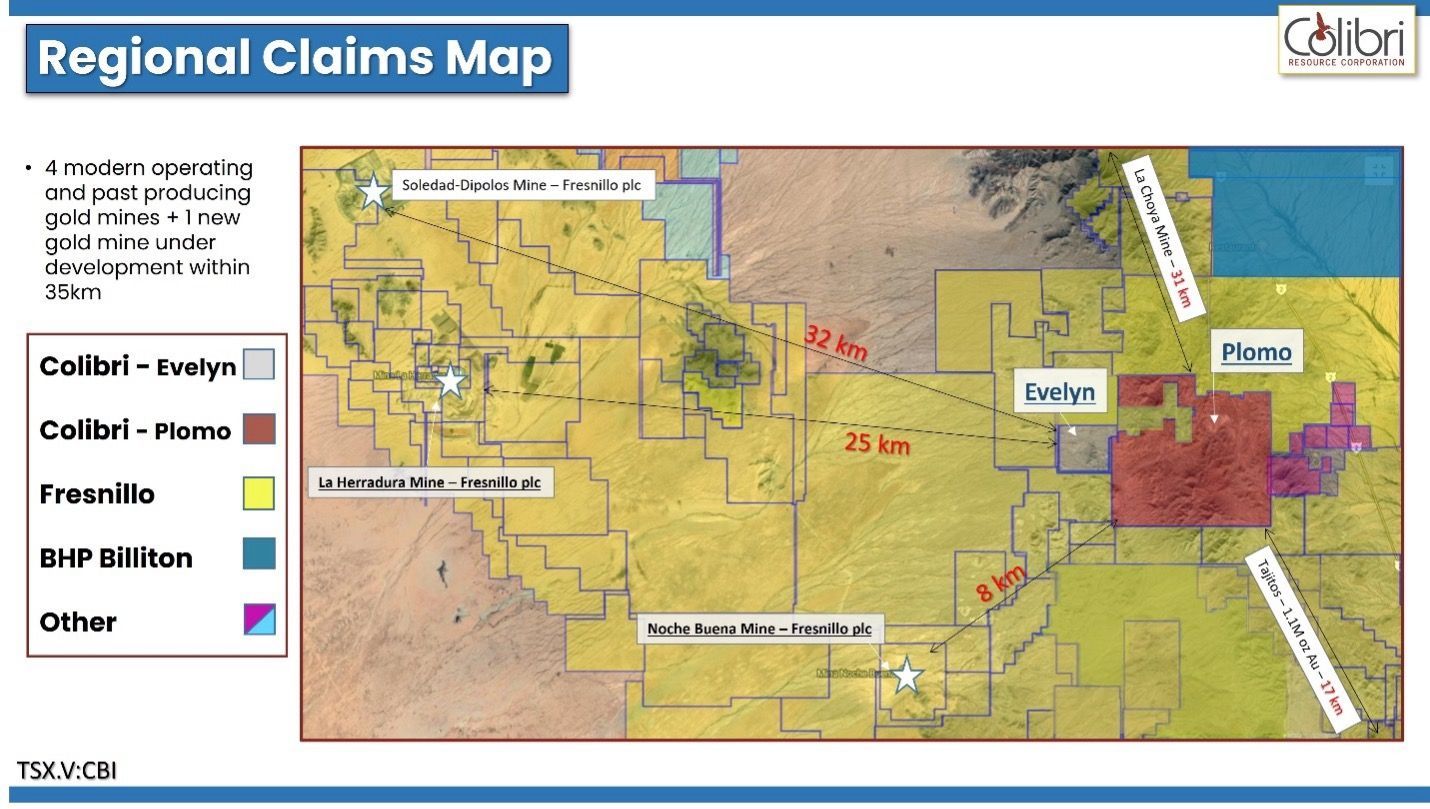

The Evelyn and Plomo properties are located in the 500 km long, northwest trending Caborca Gold belt which includes the > 15 million ounce Au La Herradura Mine (located 30 km west of Plomo) and the > 2 million ounce Au Noche Buena Mine (located approximately 8 km southwest of Plomo). Both mines are owned by Fresnillo Plc who is the largest gold producer in Mexico. The Plomo and Evelyn claims are surrounded by claims held by Fresnillo Plc. (See: Figure 1 below)

Terms

Colibri paid $100,000 CAD cash to acquire the Plomo project by way of buying 100% of the shares outstanding in Great Panther Mining’s (“Great Panther”) wholly owned subsidiaries, which hold the Plomo. The deal was successfully concluded with Great Panther’s Trustees in Bankruptcy.

Plomo History & Background

Plomo was originally acquired by Cangold Ltd. in 2006 for $100,000 in cash payments, issuance of 700,000 shares of Cangold stock (shares were trading at approximately $0.50 at the time) and issuing the vendor an additional 500,000 share purchase warrants at $0.50 per share.

The project was the target of intense exploration activity in 2006, 2007, and 2008 when Cangold completed a significant amount of mapping, geochemical sampling (1100 samples), and a 1,570m diamond drill program. The company returned to its field exploration at Plomo in 2012, sending several hundred more samples for assay and completing increasingly detailed mapping.

In 2015, Cangold was acquired by Great Panther Mining. The Plomo continued to be retained as an exploration asset with all property taxes paid semi annually.

Encouraged by its discoveries at Evelyn, Colibri signed a mutual non-disclosure agreement with Great Panther to share data mid year 2021. Based on its due diligence, Colibri forwarded an offer to purchase the Plomo Gold project for $1 million CAD in December of that year. The offer was rejected, and it was understood that Great Panther management had instead decided to complete further exploration of the Plomo in an effort to grow the company’s resources organically.

The following year, from April to November 2021, Great Panther completed exploration activities at Plomo to better understand the structures and lithologies associated with previously identified gold mineralization to determine targets for future drilling. To support this work, they retained TMC Geofisica to perform a 14.1 line kilometre 3D IP study covering the area bordering Colibri’s Evelyn project over to Plomo’s San Perfecto target. We now know that the results generated from these studies were very encouraging, however Great Panther had been experiencing significant cashflow problems due to its mining operations (as illustrated by its financial statements in published early 2022). As a result, no further exploration was funded at Plomo in 2022.

In September 2022, Great Panther filed for CCAA protection from its creditors. Colibri management reached out GPR to determine if there may now be an opportunity to buy the Plomo project and received a positive response.

Colibri geologists reviewed the updated Plomo database and in December 2022 submitted an offer to buy the Plomo Gold project, however, was subsequently informed that Great Panther had already formally filed for bankruptcy with the courts and its management were no longer the custodians of its assets. Colibri in turn submitted a modified offer of $100,000 CAD to the trustees of the GPR bankruptcy and the offer was accepted.

Ian McGavney COO of Colibri states "I am extremely happy that we were able to acquire this large piece of ground in this prime district, along with its significant geological database. Great Panther/Cangold did excellent exploration work at Plomo and unveiled a great deal of potential. The fact that we offered $1 million CAD for the project two years ago and that it was rejected by Great Panther would seem to indicate that their management also saw its upside potential. Review of their 2021 field work has only added more reasons for us to want to own this project. We were in the right place at the right time and seized the opportunity.”

ABOUT COLIBRI RESOURCE CORPORATION:

Colibri is a Canadian-based mineral exploration company listed on the TSX-V (CBI) and is focused on acquiring and exploring prospective gold & silver properties in Mexico. The Company holds seven high potential precious metal projects of which six have planned exploration programs for calendar 2023.

For more information about all Company projects please visit: www.colibriresource.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Notice Regarding Forward-Looking Statements:

This news release contains "forward-looking statements". Statements in this press release which are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, expectations, or intentions regarding the future. Actual results could differ from those projected in any forward-looking statements due to numerous factors. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Although the Company believes that the plans, expectations and intentions contained in this press release are reasonable, there can be no assurance that they will prove to be accurate.

For information contact:

Ronald J. Goguen, President, Chairperson and Director, Tel: (506) 383-4274, rongoguen@colibriresource.com

Related news releases.