NEWS RELEASE - Dieppe, NB. June 6th, 2024 - Colibri Resource Corporation (CBI-TSXV) ("Colibri" or the "Company") is pleased to report that the co-owner of its Pilar Gold & Silver Project in Sonora, Mexico, Tocvan Ventures (51% interest) has announced the results from six holes drilled in the ongoing Phase 4, RC drill program. Colibri owns a 49% interest of the Pilar Gold & Silver Project.

Highlights from Tocvan Pilar News Release – June 6th, 2024:

- Infill Drilling on Main Zone Trend Hits Several Zones Expanding Resource Potential

- JES-24-73, 16.8 meters of 0.8 g/t Au and 19 g/t Ag

- Including Polymetallic Zone of 4.6 meters of 2.2 g/t Au, 49 g/t Ag, 0.46% Cu and 1.48% Zn

- Also, 3.1 meters of 0.9 g/t Au, 10 g/t Ag and 3.2% Zn

- Also, 10.7 meters of 0.8 g/t Au and 2 g/t Ag

- And, 3.0 meters of 3.8 g/t Au and 4.7 g/t Ag

- Within 152.5-meter anomalous zone from surface averaging 0.3 g/t Au and 3 g/t Ag

- JES-24-84, 10.7 meters of 0.6 g/t Au and 3 g/t Ag

- Including 1.5 meters of 3.3 g/t Au, 14 g/t Ag and 0.67% Cu

- Within 97.6-meter anomalous zone from 48.8-meter depth of 0.1 g/t Au and 1 g/t Ag

- Large Step-out Exploration Drilling Hits Best Results to Date in Southeast Targets, Expands 4-T Trend 400m SE

- JES-24-87, Including 0.6 g/t Au and 7 g/t Ag and 0.6 g/t Au and 15 g/t Ag both over 1.5 meters

- Within 53.4 meters of 0.1 g/t Au and 2 g/t Ag

- Six Holes Released, All Six Intersect Mineralization

- Additional Results Pending. Over 2,700 meters Drilled to Date in 23 Holes

For full details please see the Tocvan Ventures news release dated June 6th, 2024 below:

Calgary, Alberta – June 6, 2024 – Tocvan Ventures Corp. (the “Company”) (CSE: TOC; OTCQB: TCVNF; FSE: TV3), is pleased to announce drill results from its 2024 Reverse Circulation (RC) drill program at its road accessible Pilar Gold-Silver project in mine-friendly Sonora, Mexico.

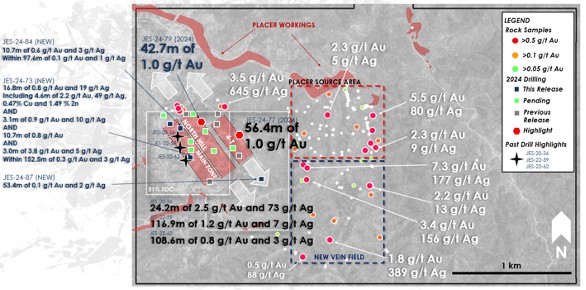

Results today highlight four infill holes along the Main Zone Trend, three of which are located on the northwest extent of the trend. Two exploration holes along the far southeast extent of the 4-T trend are also included in today’s results. Infill holes are highlighted by drillhole JES-24-73 which returned four distinct zones of mineralization that include two zones of high copper and zinc values, including 4.6 meters of 2.2 g/t Au, 49 g/t Ag, 0.46% Cu and 1.48% Zn (results are summarized in Table 1) Anomalous mineralization extends from surface to 152.5 meters vertical depth averaging 0.3 g/t Au and 3 g/t Ag across all four mineralized sections. Infill hole JES-24-84 returned 10.7 meters of 0.6 g/t Au and 3 g/t Ag within a broad anomalous zone of 97.6 meters of 0.1 g/t Au starting from 48.8 meters vertical depth. It is important to note both holes represent the extension of the Main Zone along the edges, the continuation of mineralization is a positive sign for further resource advancement. As for exploration drilling, two holes 400 meters southeast along the 4-T Trend have returned values indicating mineralization continues along this corridor. This is highlighted by JES-24-87 which returned 53.4 meters of 0.1 g/t Au and 2 g/t Ag, the broadest zone of gold-silver mineralization recorded in exploration drilling to date and over 700 meters from the Main Zone.

Over 2,700 meters have been drilled to date for the 2024 program. Results for eight drill holes are currently pending analysis (green squares on Figure 1). Drilling is ongoing at Pilar.

“The results today give us numerous reasons to be excited about the potential of Pilar.” commented Brodie Sutherland, CEO. “Not only are we continuing to increase the resource potential on the outer edges of the Main Zone but have successfully hit significant mineralization in two exploration holes 700 meters away. With all good exploration, it takes time to focus in on key targets, the latest results are providing us with the evidence needed to further evaluate the southeast extent of the several known trends. The polymetallic results returned at the Main Zone are likely related to breccia phases encountered in previous core drilling (JES-22-61) 40m to the northwest, where elevated gold, silver and zinc were recorded. The presence of multiple breccia and vein phases at Pilar is what makes it an attractive target, it is a complex and robust system that we feel is just starting to take shape. In addition, the interest from a major producer in the greater expansion area potential is a clear sign we are taking the right steps to advance the area further and getting the attention we feel the project deserves.”

Discussion of Results

JES-24-73

The drillhole targeted near surface mineralization next to and down-dip of past core drillhole JES-22-62, which returned 108.6 meters of 0.8 g/t Au and 3 g/t Ag. Important to note that JES-22-62 was a significant 125-meter step out southeast of the Main Zone at the time representing a significant increase in resource size. JES-24-73 returned anomalous mineralization from surface to a vertical depth of 152.5 meters, with four distinct higher-grade intervals. Two of which returned intervals with elevated copper and zinc with gold and silver, represented by 4.6 meters of 2.2 g/t Au, 49 g/t Ag, 0.46% Cu, 1.48% Zn from 54.9 meters depth and 3.1 meters of 0.9 g/t Au, 10 g/t Ag and 3.2% Zn from 77.8 meters depth. These zones look to correlate with a silicified magnetite rich breccia encountered in past drillhole JES-22-61 (63.4m of 0.6 g/t Au and 11 g/t Ag) 40 meters to the northwest. The Company is encouraged by these results and further infill drilling to the north has been completed with results pending.

North Extent of Main Zone Trend

JES-24-83, 84 and 85

Three drillholes targeted gaps in the database along the northern extent of the Main Zone Trend. All three holes returned anomalous mineralization. JES-24-83 returned 102.2 meters of 0.1 g/t Au from 10.7 meters vertical depth, this includes near surface gold values up to 3.5 g/t Au over 1.5 meters from 10.7 meters. Copper values up to 0.69% Cu over 1.5 meters were returned along with gold and silver (0.2 g/t Au, 14 g/t Ag). Elevated copper values are common on the north end of the Main Zone and North Hill Trends. JES-24-84 returned 97.6 meters of 0.1 g/t Au from 48.8 meters vertical depth, including 10.7 meters of 0.6 g/t Au, 3 g/t Ag and 0.17% Cu from 108.3 meters vertical depth. JES-24-85 was drilled off the same pad as JES-24-84, westward at a 45-degree angle. Four weaker zones of mineralization were recorded to a downhole depth of 123.5 meters.

Exploration Drill Results

4-T Trend South Extensions

Drillholes JES-24-86 and 87 tested the far southern extension (400m southeast) of the 4-T Trend where limited data exists. The two holes were drilled from the same pad in opposite directions (315 and 135 azimuths). Both returned anomalous mineralization with JES-24-87 returning the best result thus far, 53.4 meters of 0.1 g/t Au and 2 g/t Ag from 45.8 meters downhole depth, including two, 1.5-meter zones of 0.6 g/t Au. The Company views these early exploration results as extremely positive as they greatly expand the mineralization potential along the southern extent of these corridors.

Table 1. Summary of Drill Results Released Today from Pilar Project.

All interval lengths are drilled widths. 10,000 ppm = 1%

| Hole ID | From (m) | To (m) | Width (m) | Au (g/t) | Ag (g/t) | Cu (ppm) | Pb (ppm) | Zn (ppm) |

|---|---|---|---|---|---|---|---|---|

| JES-24-73 | 0 | 152.5 | 152.5 | 0.26 | 3 | 293 | 63 | 1,818 |

| including | 0 | 21.35 | 21.35 | 0.11 | 0.55 | 81 | 15 | 96 |

| also | 32.05 | 61 | 28.96 | 0.46 | 12.32 | 937 | 43 | 4,783 |

| including | 44.23 | 61 | 16.78 | 0.76 | 18.7 | 1,532 | 56 | 8,006 |

| including | 54.9 | 59.48 | 4.58 | 2.23 | 48.68 | 4,643 | 140 | 14,806 |

| also | 77.78 | 80.83 | 3.05 | 0.89 | 9.65 | 649 | 93 | 32,100 |

| also | 103.7 | 129.63 | 25.93 | 0.35 | 0.96 | 374 | 32 | 270 |

| including | 112.85 | 123.53 | 10.68 | 0.75 | 1.91 | 794 | 23 | 254 |

| also | 149.5 | 152.5 | 3 | 3.83 | 4.67 | 238 | 1,558 | 1,569 |

| JES-24-83 | 10.68 | 112.85 | 102.18 | 0.1 | 1.34 | 534 | 23 | 124 |

| including | 10.68 | 12.2 | 1.53 | 3.53 | 0.25 | 117 | 12 | 118 |

| also | 36.6 | 38.13 | 1.53 | 0.09 | 9.43 | 93 | 27 | 173 |

| also | 53.38 | 64.05 | 10.68 | 0.2 | 2.68 | 1,131 | 26 | 135 |

| including | 53.38 | 54.9 | 1.53 | 0.56 | 2.5 | 2,200 | 19 | 194 |

| and | 62.53 | 64.05 | 1.53 | 0.62 | 1.5 | 107 | 18 | 101 |

| also | 77.78 | 79.3 | 1.52 | 0.24 | 1 | 29 | 19 | 80 |

| also | 99.13 | 112.85 | 13.73 | 0.06 | 3.8 | 1,957 | 43 | 157 |

| JES-24-84 | 48.8 | 146.4 | 97.6 | 0.11 | 0.99 | 394 | 20 | 164 |

| including | 48.8 | 53.38 | 4.58 | 0.22 | 1.2 | 300 | 11 | 138 |

| and | 67.1 | 68.63 | 1.53 | 0.03 | 7.42 | 95 | 25 | 446 |

| and | 86.93 | 88.45 | 1.53 | 0.21 | 0.25 | 98 | 19 | 255 |

| and | 100.65 | 102.18 | 1.52 | 0.17 | 0.5 | 397 | 18 | 114 |

| and | 108.28 | 118.95 | 10.68 | 0.62 | 3.4 | 1,772 | 19 | 177 |

| including | 108.28 | 109.8 | 1.52 | 3.34 | 14.15 | 6,790 | 32 | 200 |

| also | 144.88 | 146.4 | 1.53 | 0.15 | 0.25 | 13 | 19 | 134 |

| JES-24-85 | 42.7 | 45.75 | 3.05 | 0.11 | 0.73 | 266 | 25 | 4,375 |

| and | 82.35 | 88.45 | 6.1 | 0.1 | 0.39 | 157 | 26 | 89 |

| and | 99.13 | 105.23 | 6.1 | 0.19 | 1.29 | 36 | 20 | 156 |

| including | 99.13 | 100.65 | 1.53 | 0.51 | 1.8 | 13 | 25 | 151 |

Table 2. Drillhole locations released today.

| Hole ID | Azimuth | Dip | Depth (m) | Easting | Northing | Elevation (m) |

|---|---|---|---|---|---|---|

| JES-24-73 | 0 | -90 | 201.3 | 617507 | 3144450 | 444 |

| JES-24-83 | 0 | -90 | 122 | 617368 | 3144801 | 400 |

| JES-24-84 | 0 | -90 | 179.95 | 617453 | 3144713 | 393 |

| JES-24-85 | 90 | -45 | 128.1 | 617456 | 3144713 | 393 |

| JES-24-86 | 315 | -45 | 120.48 | 618113 | 3144285 | 412 |

| JES-24-87 | 135 | -45 | 131.15 | 618117 | 3144277 | 412 |

Table 3. Exploration Drill Results and Pathfinder Geochemistry

| Hole ID | From (m) | To (m) | Width (m) | Au (g/t) | Ag (g/t) | Cu (ppm) | Pb (ppm) | Zn | As | Mo | Sb |

|---|---|---|---|---|---|---|---|---|---|---|---|

| (ppm) | (ppm) | (ppm) | (ppm) | ||||||||

| JES-24-86 | 24.4 | 35.075 | 10.68 | 0.2 | 1.2 | 27 | 242 | 512 | 663 | NSV | 9 |

| including | 24.4 | 25.925 | 1.53 | 0.82 | 3.2 | 21 | 1035 | 503 | 4310 | NSV | 12 |

| JES-24-87 | 28.975 | 30.5 | 1.53 | 0.17 | 1.1 | 14 | 674 | 755 | 32 | NSV | NSV |

| and | 45.75 | 99.125 | 53.38 | 0.09 | 2.15 | 60 | 522 | 922 | 214 | NSV | 8 |

| including | 45.75 | 50.325 | 4.58 | 0.35 | 2.85 | 144 | 968 | 1947 | 59 | NSV | 10 |

| including | 45.75 | 47.275 | 1.53 | 0.63 | 6.5 | 253 | 2210 | 3860 | 80 | NSV | 10 |

| also | 70.15 | 71.675 | 1.52 | 0.24 | 7.5 | 166 | 4530 | 6290 | 53 | NSV | 6 |

| also | 80.825 | 82.35 | 1.52 | 0.34 | 13.8 | 69 | 598 | 785 | 207 | NSV | 23 |

| also | 97.6 | 99.125 | 1.53 | 0.63 | 14.5 | 36 | 278 | 243 | 5090 | NSV | 29 |

The Pilar Gold-Silver property has returned some of the regions best drill results. Coupled with encouraging gold and silver recovery results from metallurgical test work, Pilar is primed to be a potential near-term producer. Pilar is interpreted as a structurally controlled low-sulphidation epithermal system hosted in andesite rocks. Initially three primary zones of mineralization were identified on the original property from historic surface work and drilling and are referred to as the Main Zone, North Hill and 4-T. Each trend remains open to the southeast and north and new parallel zones have been discovered. Structural features and zones of mineralization within the structures follow an overall NW-SE trend of mineralization.

Mineralization extends along a 1.2-km trend, only half of that trend has been drill tested so far.

Pilar Drill Highlights:

· 2022 Phase III Diamond Drilling Highlights include (all lengths are drilled thicknesses):

o 116.9m @ 1.2 g/t Au, including 10.2m @ 12 g/t Au and 23 g/t Ag

o 108.9m @ 0.8 g/t Au, including 9.4m @ 7.6 g/t Au and 5 g/t Ag

o 63.4m @ 0.6 g/t Au and 11 g/t Ag, including 29.9m @ 0.9 g/t Au and 18 g/t Ag

· 2021 Phase II RC Drilling Highlights include (all lengths are drilled thicknesses):

o 39.7m @ 1.0 g/t Au, including 1.5m @ 14.6 g/t Au

o 47.7m @ 0.7 g/t Au including 3m @ 5.6 g/t Au and 22 g/t Ag

o 29m @ 0.7 g/t Au

o 35.1m @ 0.7 g/t Au

· 2020 Phase I RC Drilling Highlights include (all lengths are drilled thicknesses):

o 94.6m @ 1.6 g/t Au, including 9.2m @ 10.8 g/t Au and 38 g/t Ag;

o 41.2m @ 1.1 g/t Au, including 3.1m @ 6.0 g/t Au and 12 g/t Ag ;

o 24.4m @ 2.5 g/t Au and 73 g/t Ag, including 1.5m @ 33.4 g/t Au and 1,090 g/t Ag

· 15,000m of Historic Core & RC drilling. Highlights include:

- 61.0m @ 0.8 g/t Au

o 21.0m @ 38.3 g/t Au and 38 g/t Ag

o 13.0m @ 9.6 g/t Au

o 9.0m @ 10.2 g/t Au and 46 g/t Ag

Pilar Bulk Sample Summary:

· 62% Recovery of Gold Achieved Over 46-day Leaching Period

· Head Grade Calculated at 1.9 g/t Au and 7 g/t Ag; Extracted Grade Calculated at 1.2 g/t Au and 3 g/t Ag

· Bulk Sample Only Included Coarse Fraction of Material (+3/4” to +1/8”)

· Fine Fraction (-1/8”) Indicates Rapid Recovery with Agitated Leach

o Agitated Bottle Roll Test Returned Rapid and High Recovery Results: 80% Recovery of Gold and 94% Recovery of Silver after Rapid 24-hour Retention Time

Additional Metallurgical Studies:

· Gravity Recovery with Agitated Leach Results of Five Composite Samples Returned

o 95 to 99% Recovery of Gold

o 73 to 97% Recovery of Silver

o Includes the Recovery of 99% Au and 73% Ag from Drill Core Composite at 120-meter depth.

Quality Assurance / Quality Control

RC samples were shipped for sample preparation to ALS Limited in Hermosillo, Sonora, Mexico and for analysis at the ALS laboratory in North Vancouver. The ALS Hermosillo and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Gold was analyzed using 50-gram nominal weight fire assay with atomic absorption spectroscopy finish. Over limits for gold (>10 g/t), were analyzed using fire assay with a gravimetric finish. Silver and other elements were analyzed using a four-acid digestion with an ICP finish. Over limit analyses for silver (>100 g/t) were re-assayed using an ore-grade four-acid digestion with ICP-AES finish. Control samples comprising certified reference samples and blank samples were systematically inserted into the sample stream and analyzed as part of the Company’s robust quality assurance / quality control protocol.

Brodie A. Sutherland, CEO for Tocvan Ventures Corp. and a qualified person ("QP") as defined by Canadian National Instrument 43-101, has reviewed and approved the technical information contained in this release.

ABOUT COLIBRI RESOURCE CORPORATION:

Colibri is a Canadian-based mineral exploration company listed on the TSX-V (CBI) and is focused on acquiring, exploring, and developing prospective gold & silver properties in Mexico. The Company holds five high potential precious metal projects: 1) 100% of EP Gold Project in the significant Caborca Gold Belt which has delivered highly encouraging exploration results and is surround by Mexico’s second largest major producer of gold on four sides, 2) 49% Ownership of the Pilar Gold & Silver Project which is believed to hold the potential to be a near term producing mine, and 3) three highly prospective interests in the Sierra Madre (Diamante Gold & Silver Project, Jackie Gold & Silver Project, and Mezquite Gold & Silver Project.

For more information about all Company projects please visit: www.colibriresource.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Notice Regarding Forward-Looking Statements:

This news release contains "forward-looking statements". Statements in this press release which are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, expectations or intentions regarding the future. Actual results could differ from those projected in any forward-looking statements due to numerous factors. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Although the Company believes that the plans, expectations, and intentions contained in this press release are reasonable, there can be no assurance that they will prove to be accurate.

For information contact:

Ian McGavney, President, CEO and Director, Tel: (506) 383-4274, ianmcgavney@colibriresource.com

Related news releases.