NEWS RELEASE - Dieppe, NB. May 23rd, 2024 - Colibri Resource Corporation (CBI-TSXV) ("Colibri" or the "Company") is pleased to report that the co-owner of its Pilar Gold & Silver Project in Sonora, Mexico, Tocvan Ventures (51% interest) has announced the results from five holes drilled in the ongoing Phase 4, RC drill program. Hole JES-24-79 was drilled in the North Hill Trend area and is reported to be the second-best gold intersection to date outside of the Main Zone. Colibri owns a 49% interest in the Pilar Gold & Silver Project.

Highlights from Tocvan Pilar News Release – May 23rd, 2024:

- Drilling Intersects 42.7 meters of 1.0 g/t Au, 22.9 meters from Surface in Drillhole JES-24-79

- Including 3.1 meters of 10.9 g/t Au, 38.1 meters from surface

- Second Best Intersect Outside of Main Zone to Date, 300 meters Northeast of Main Zone

- 300 meters west-northwest of Previously Released JES-24-77, 56.4m of 1.0 g/t Au and 1 g/t Ag

- Continues to Build Resource Potential Along North Hill Corridor

- Anomalous Exploration Results Provide Key Indications to Trend Extensions

- Additional Results Pending

For full details please see the Tocvan Ventures news release dated May 23rd, 2024 below:

Calgary, Alberta – May 23, 2024 – Tocvan Ventures Corp. (the “Company”) (CSE: TOC; OTCQB: TCVNF; FSE: TV3), is pleased to announce drill results from its 2024 Reverse Circulation (RC) drill program at its road accessible Pilar Gold-Silver project in mine-friendly Sonora, Mexico.

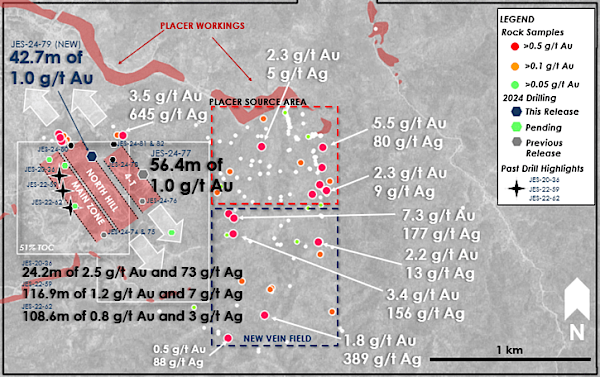

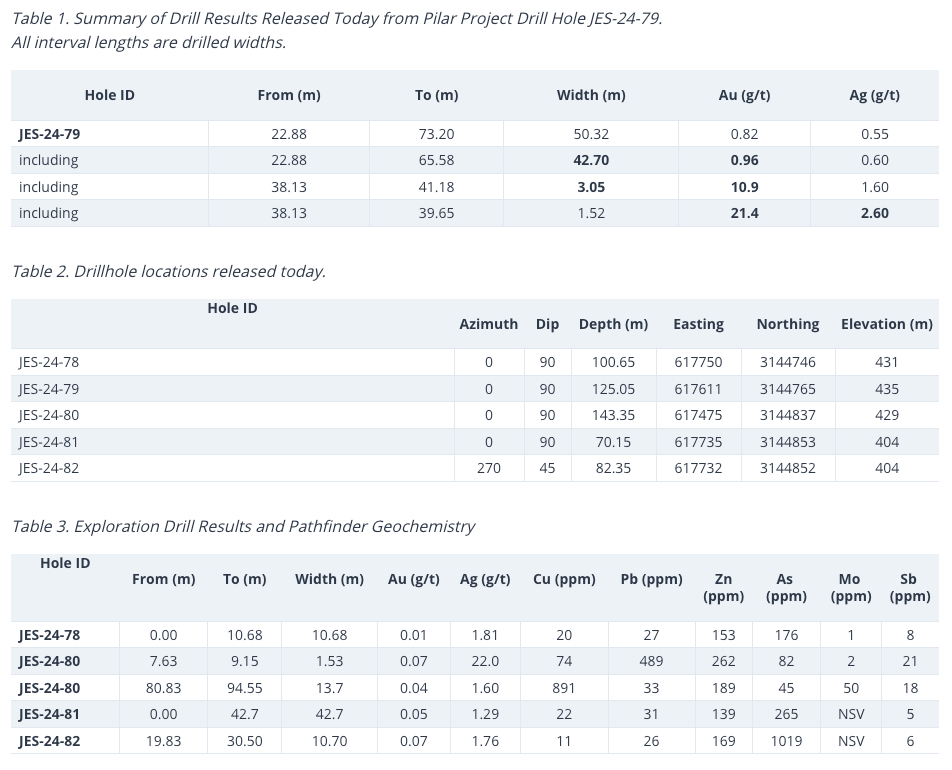

Results today are highlighted by drillhole JES-24-79 which returned 42.7 meters of 1.0 g/t Au from 22.9 meters vertical depth, including 3.1 meters of 10.9 g/t Au. Anomalous gold values averaging 50.3 meters of 0.8 g/t Au was encountered in the hole. A high-grade center to the mineralized zone returned 10.9 g/t Au and 2 g/t Ag over 3.1 meters, including 1.5 meters of 21.4 g/t Au. Like the Main Zone, the North Hill trend is exposed at surface along a rounded ridge top, allowing the potential for a low strip ratio during early development. The hole tested near-surface mineralization and was stopped at 125.1 meters, mineralization at North Hill remains open along trend and to the east. In addition, four exploration holes on the northeastern flanks of known mineralization (JES-24-78, 80, 81 and 82) are also included in this release.

Results for six drill holes are currently pending analysis. Drilling is ongoing at Pilar.

“The results today support the significant resource potential beyond the Main Zone.” commented Brodie Sutherland, CEO. “Today’s results hit one of the best holes ever off the North Hill Trend providing added confidence in identifying additional high-grade mineralization. Much of the trend has yet to be tested and remains open for expansion. The proximity to parallel trends bodes well for tying together a large bulk tonnage target. Early exploration results are showing great indications a larger robust mineralized system is present. With each phase we are get closer to identifying new mineralization close to surface that can be added to our maiden resource estimate. As drilling continues we look forward to updating our shareholders on additional results.”

Discussion of Results

JES-24-79

The drillhole targeted near surface mineralization vertically below a previous drillhole completed by Tocvan in 2021, JES-21-53, which returned 15.3 meters of 1.1 g/t Au. JES-24-79 returned 42.7 meters of 1.0 g/t Au from 22.9 meters depth including high-grade mineralization up to 21.4 g/t Au over 1.5 meters. The hole is located 300 meters to the west-northwest of the previously announced JES-24-77 (56.4 meters of 1.0 g/t Au) and 300 meters northeast of the Main Zone centered around drillhole JES-22-59 (116.9 meters of 1.2 g/t Au and 7 g/t Ag). The trend remains open to the northwest, southeast and east. The North Hill corridor is a 500-meter-long trend that extends from surface mineralization to the north, southward towards past drillhole JES-22-72 which returned 10.7 meters of 0.6 g/t Au and 40 g/t Ag from 27.5 meters downhole depth. Today’s result greatly increases the near surface resource potential along this trend.

Exploration Drill Results

4-T Trend North Extensions

Drillholes JES-24-78, 81 & 82 all tested the northern extension of the 4-T Trend where little data exists. The Company is encouraged by the early results of ideal host lithologies, alteration and elevated pathfinder elements. The upper part of hole JES-24-78 hosted elevated silver, arsenic and antimony, all key pathfinder elements for close proximity to epithermal mineralization. JES-24-81 returned a zone from surface down to 42.7 meters of elevated gold, silver, arsenic and antimony all great indications of continued mineralization to the north. Hole JES-24-82 returned a 10.7-meter zone of elevated gold, silver and arsenic further verifying the continuation of mineralization along trend.

North Hill Extension

Drillhole JES-24-80 tested the northeastern edge of the North Hill Trend. Elevated values of silver, copper, zinc, molybdenum, and antimony were reported. A 13.7-meter zone of elevated silver, copper, arsenic, molybdenum and antimony was reported from 80.8 meters vertical depth. An excellent indicator to close proximity to mineralization and elevated copper as seen at surface and across other drillholes at North Hill.

About the Pilar Property

The Pilar Gold-Silver property has returned some of the regions best drill results. Coupled with encouraging gold and silver recovery results from metallurgical test work, Pilar is primed to be a potential near-term producer. Pilar is interpreted as a structurally controlled low-sulphidation epithermal system hosted in andesite rocks. Initially three primary zones of mineralization were identified on the original property from historic surface work and drilling and are referred to as the Main Zone, North Hill and 4-T. Each trend remains open to the southeast and north and new parallel zones have been discovered. Structural features and zones of mineralization within the structures follow an overall NW-SE trend of mineralization. Mineralization extends along a 1.2-km trend, only half of that trend has been drill tested so far. The Company has now expanded its interest in the area by consolidating 22 square-kilometers of highly prospective ground where it has already made significant surface discoveries.

Pilar Drill Highlights:

- 2022 Phase III Diamond Drilling Highlights include (all lengths are drilled thicknesses):

- 116.9m @ 1.2 g/t Au, including 10.2m @ 12 g/t Au and 23 g/t Ag

- 108.9m @ 0.8 g/t Au, including 9.4m @ 7.6 g/t Au and 5 g/t Ag

- 63.4m @ 0.6 g/t Au and 11 g/t Ag, including 29.9m @ 0.9 g/t Au and 18 g/t Ag

- 2021 Phase II RC Drilling Highlights include (all lengths are drilled thicknesses)

- 39.7m @ 1.0 g/t Au, including 1.5m @ 14.6 g/t Au

- 47.7m @ 0.7 g/t Au including 3m @ 5.6 g/t Au and 22 g/t Ag

- 29m @ 0.7 g/t Au

- 35.1m @ 0.7 g/t Au

2020 Phase I RC Drilling Highlights include (all lengths are drilled thicknesses):

- 94.6m @ 1.6 g/t Au, including 9.2m @ 10.8 g/t Au and 38 g/t Ag;

- 41.2m @ 1.1 g/t Au, including 3.1m @ 6.0 g/t Au and 12 g/t Ag ;

- 24.4m @ 2.5 g/t Au and 73 g/t Ag, including 1.5m @ 33.4 g/t Au and 1,090 g/t Ag

15,000m of Historic Core & RC drilling. Highlights include:

- 61.0m @ 0.8 g/t Au

- 21.0m @ 38.3 g/t Au and 38 g/t Ag

- 13.0m @ 9.6 g/t Au

- 9.0m @ 10.2 g/t Au and 46 g/t Ag

Pilar Bulk Sample Summary:

- 62% Recovery of Gold Achieved Over 46-day Leaching Period

- Head Grade Calculated at 1.9 g/t Au and 7 g/t Ag; Extracted Grade Calculated at 1.2 g/t Au and 3 g/t Ag

- Bulk Sample Only Included Coarse Fraction of Material (+3/4” to +1/8”)

- Fine Fraction (-1/8”) Indicates Rapid Recovery with Agitated Leach

- Agitated Bottle Roll Test Returned Rapid and High Recovery Results: 80% Recovery of Gold and 94% Recovery of Silver after Rapid 24-hour Retention Time

Additional Metallurgical Studies:

- Gravity Recovery with Agitated Leach Results of Five Composite Samples Returned

- 95 to 99% Recovery of Gold

- 73 to 97% Recovery of Silver

- Includes the Recovery of 99% Au and 73% Ag from Drill Core Composite at 120-meter depth.

About Colibri Resource Corporation:

Colibri is a Canadian-based mineral exploration company listed on the TSX-V (CBI) and is focused on acquiring, exploring, and developing prospective gold & silver properties in Mexico. The Company holds five high potential precious metal projects: 1) 100% of EP Gold Project in the significant Caborca Gold Belt which has delivered highly encouraging exploration results and is surround by Mexico’s second largest major producer of gold on four sides, 2) 49% Ownership of the Pilar Gold & Silver Project which is believed to hold the potential to be a near term producing mine, and 3) three highly prospective interests in the Sierra Madre (Diamante Gold & Silver Project, Jackie Gold & Silver Project, and Mezquite Gold & Silver Project.

For more information about all Company projects please visit: www.colibriresource.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Notice Regarding Forward-Looking Statements:

This news release contains "forward-looking statements". Statements in this press release which are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, expectations or intentions regarding the future. Actual results could differ from those projected in any forward-looking statements due to numerous factors. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Although the Company believes that the plans, expectations, and intentions contained in this press release are reasonable, there can be no assurance that they will prove to be accurate.

For information contact: Ian McGavney, President, CEO and Director, Tel: (506) 383-4274, ianmcgavney@colibriresource.com

Related news releases.