NEWS RELEASE - DIEPPE, N.B., September 16, 2025 -- Colibri Resource Corporation (“Colibri” or the “Company”) (CBI: TSX-V) is pleased to provide a corporate update, outlining near-term initiatives to advance its 100%-owned EP Gold Project and highlight the significant potential of its 49% interest in the advanced Pilar Gold-Silver Project in Sonora, Mexico.

Positioned for Growth in a Strong Precious Metals Market

With gold and silver trading near historic highs, Colibri is actively advancing initiatives designed to increase shareholder value. The Company is pursuing a staged growth strategy focused on:

- Advancing exploration at EP Gold,

- Supporting development of Pilar, and

- Strengthening market visibility and corporate positioning.

EP Gold Project – District-Scale Potential in the Heart of the Caborca Belt

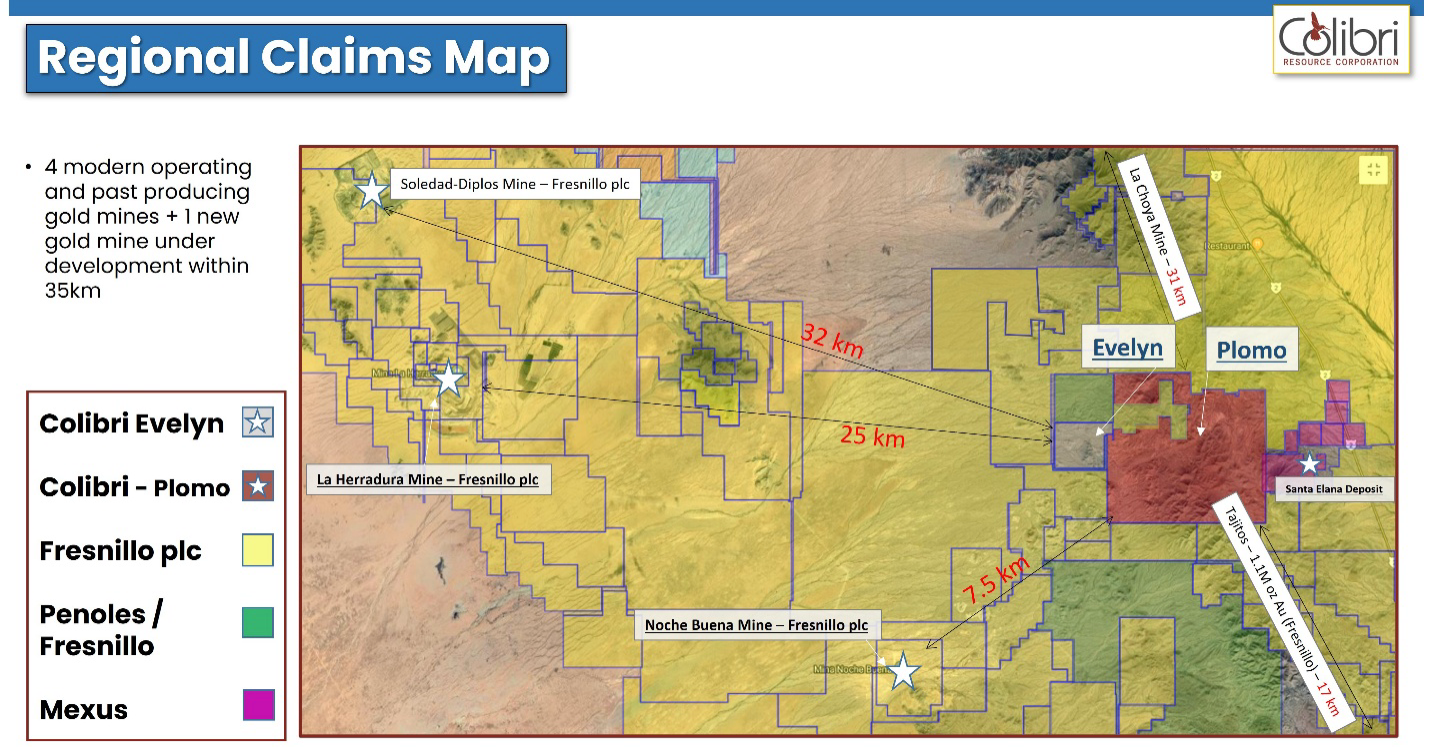

Colibri’s 100%-owned EP Gold Project (Evelyn/Plomo) covers 4,766 hectares in the Caborca Gold Belt of Sonora, Mexico — one of the country’s most prolific mining districts. The Project is strategically located within 25 kilometres of some of Fresnillo Plc’s most significant gold operations, including the producing La Herradura Mine and Noche Buena Mine, as well as the Tajitos deposit (which is reportedly undergoing an updated Preliminary Economic Assessment).

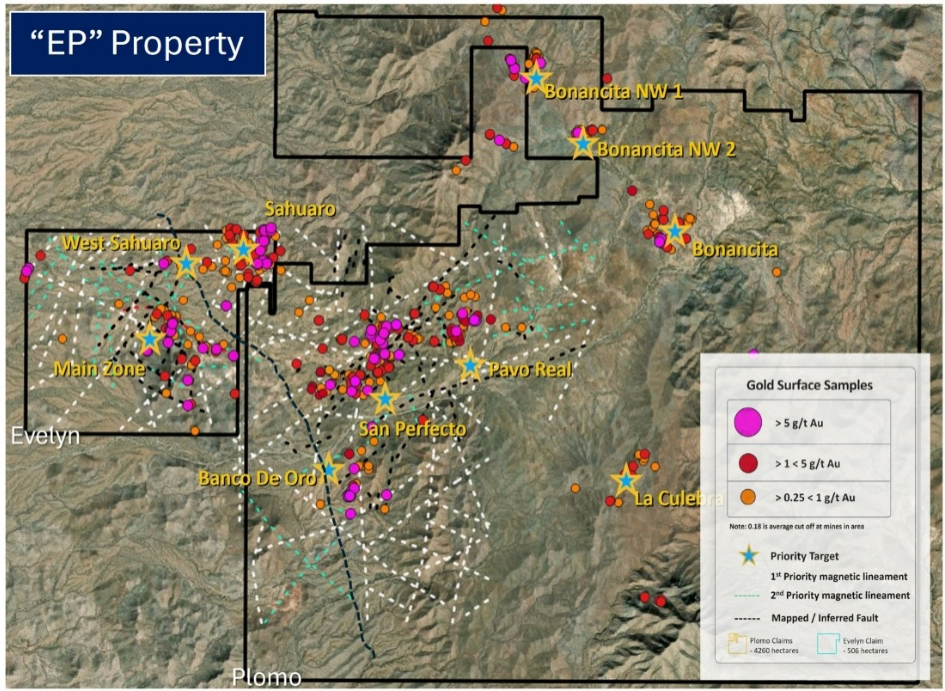

Work completed to date includes over 12,000 metres of drilling¹, more than 2,500 surface samples with abundant high-grade gold values², and geophysical surveys covering over 1,000 hectares³. Yet, only three of ten high-priority targets have been drill tested¹, leaving considerable exploration upside.

Colibri is preparing for the next stage of work at EP, which will include:

- Drill testing new zones,

- Expanding areas of known mineralization, and

- Applying modern exploration technologies to evaluate the full property and assess additional historical workings for further potential.

These initiatives highlight the opportunity for EP to emerge as a district-scale gold discovery in one of Mexico’s most proven belts. Colibri expects to update investors on the next phases of exploration at EP over the coming months.

Pilar JV

Colibri holds a 49% interest in the Pilar Gold-Silver Project, operated by Tocvan Ventures (CSE: TOC). Pilar has been advanced through >24,000 metres of drilling, trenching, and surface work⁴, as well as a 1,400-tonne bulk sample completed in 2023 that returned an average head grade of 1.9 g/t Au with recoveries of ~63% using simple heap leach methods⁵. Follow-up metallurgical test work demonstrated rapid gold recovery potential of 95–99% under agitated leach conditions⁶.

In August 2025, Tocvan secured permits for a 50,000-tonne pilot mine facility approximately 1 km from Pilar⁷. While decisions on allocation of JV material remain under review, the facility provides a compelling option for larger-scale testing. Pilar is believed to host sufficient mineralized material to support the full 50,000-tonne test, positioning the project for a meaningful demonstration of its potential. The facility offers a timely and strategic opportunity for larger-scale evaluation of Pilar while gold prices remain near record highs.

Near-term catalysts for Pilar include:

- Initiation of the 50,000-tonne pilot bulk sample program,

- Delivery of a maiden resource estimate, and

- Completion of a Preliminary Economic Assessment (PEA).

Strengthening the Balance Sheet & Market Awareness

To support these project milestones, Colibri is advancing a broader corporate strategy that includes:

- Debt Conversion/New Debenture: With previous debentures now expired, the Company is encouraging holders to convert outstanding debt into equity or participate in a new debenture financing under revised conditions.

- Equity Financing: Evaluating financing options to ensure Colibri is well funded to advance exploration and corporate objectives.

- Marketing Initiatives: Targeted campaigns designed to expand visibility and attract new investor interest.

Additional updates on these initiatives are expected in the near term.

Management Commentary

“Colibri is executing a clear, staged growth plan at an opportune time for precious metals,” said Ian McGavney, President & CEO. “With district-scale exploration potential at EP and Pilar advancing toward development with infrastructure now permitted nearby, Colibri is well positioned to deliver meaningful value for shareholders.”

Qualified Person

The technical and scientific information contained in this news release has been reviewed and approved by Mark Smethurst, P.Geo., [Director of Colibri], a Qualified Person as defined by National Instrument 43-101.

References

- Colibri Resource Corp. News Release, June 15, 2023. “Colibri Completes 2023 Drilling Program at Evelyn Project.”

- Colibri Resource Corp. News Release, Nov 20, 2022. “Surface Sampling Program Returns High-Grade Results at EP Project.”

- Colibri Resource Corp. News Release, May 5, 2021. “Colibri Completes Geophysical Survey at Evelyn Project.”

- Tocvan Ventures Corp. News Release, March 2024. “Pilar Project Update: Drilling and Surface Work Totals.”

- Tocvan Ventures Corp. News Release, Oct 5, 2023. “Bulk Sample Results at Pilar Gold-Silver Project.”

- Tocvan Ventures Corp. News Release, Dec 2023. “Follow-Up Metallurgical Testing at Pilar Demonstrates Rapid Recovery.”

- Tocvan Ventures Corp. News Release, Aug 14, 2025. “Tocvan Secures Full Permit Approval for Pilot Mine Facility at Gran Pilar.”

About Colibri Resource Corporation

Colibri is a Canadian-based mineral exploration company listed on the TSX-V (CBI) and is focused on acquiring, exploring, and developing prospective gold & silver properties in Sonora, Mexico. The Company holds three high potential precious metal projects: 1) 49% Ownership of the Pilar Gold & Silver Project which is believed to hold the potential to be a near term producing mine, 2) 100% of EP Gold Project in the significant Caborca Gold Belt which has delivered highly encouraging exploration results and is surround by Mexico’s second-largest major producer of gold on four sides, and 3) a 60% interest in the Diamante Gold & Silver Project.

For more information about all Company projects please visit:

www.colibriresource.com.

ON BEHALF OF THE BOARD

Ian McGavney

President, CEO and Director

Tel: (506) 383-4274

Email: ianmcgavney@colibriresource.com

Notice Regarding Forward-Looking Statements

This news release contains “forward-looking statements”. Statements in this press release which are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, expectations or intentions regarding the future. Actual results could differ from those projected in any forward-looking statements due to numerous factors. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Although the Company believes that the plans, expectations and intentions contained in this press release are reasonable, there can be no assurance that they will prove to be accurate.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Related news releases.