NEWS RELEASE - DIEPPE, N.B., June 17, 2025 -- Colibri Resource Corporation (“Colibri” or the “Company”) (CBI: TSX-V) is pleased to announce the results of its Annual General Meeting (“AGM”) of shareholders held on June 13, 2025.

A total of 9,451,871 common shares were represented in person or by proxy at the meeting, representing approximately 8.19% of the Company’s issued and outstanding shares as of the record date. Shareholders voted in strong support of all resolutions, each of which was approved with 99.88% of the votes cast.

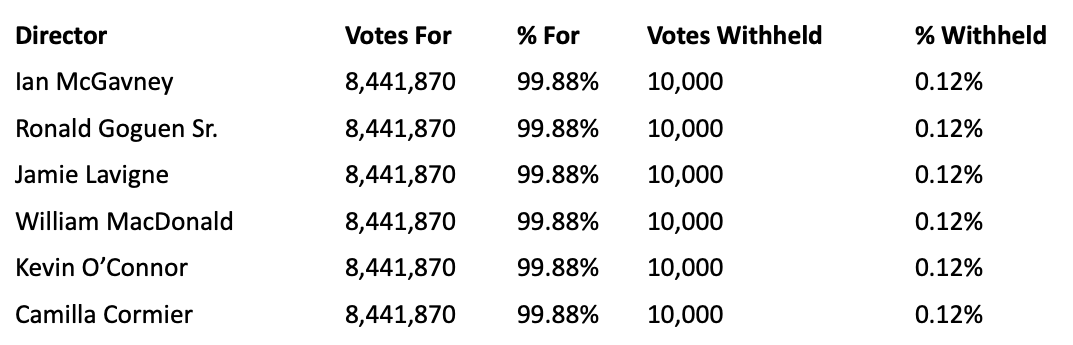

Election of Directors

The following individuals were elected as directors of the Company until the next annual general meeting or until their successors are duly elected or appointed:

Appointment of Auditors

Shareholders approved the appointment of Kreston GTA LLP as the Company’s auditors for the ensuing year and authorized the board of directors to fix their remuneration:

- Votes For: 8,441,870 (99.88%)

- Votes Withheld: 10,000 (0.12%)

Approval of Stock Option Plan

Shareholders also re-approved the Company’s 10% rolling stock option plan, as required annually by TSX Venture Exchange policy:

- Votes For: 8,441,870 (99.88%)

- Votes Against: 10,000 (0.12%)

The Company thanks its shareholders for their continued support and confidence. Colibri remains committed to advancing its gold exploration portfolio in Sonora, Mexico, with a focus on the Pilar Gold & Silver joint venture and the EP Gold Project Project.

About Colibri Resource Corporation

Colibri Resource Corporation is a Canadian-based junior gold and silver exploration company focused on high-potential projects in Sonora, Mexico. The Company holds interests in:

- The Pilar Gold & Silver Project, a joint venture with Tocvan Ventures in which Colibri owns 49%. Pilar hosts a shallow oxide gold system where surface trenching, bulk sampling, and preliminary metallurgy support near-term development potential.

- The EP Gold Project, 100%-owned and located 25 km east of Mexico’s largest open-pit gold mine, La Herradura. Drilling, surface sampling, geophysical study and mapping have identified multiple structural targets with strong geochemical anomalies.

- The Diamante Project, now 60%-owned through full ownership of Yaque Minerales. Diamante hosts extensive gold-silver and base metal epithermal systems across multiple mineralized corridors.

For information contact:

Ian McGavney

President, CEO and Director

Tel: (506) 383-4274

Email: ianmcgavney@colibriresource.com

This news release contains "forward-looking statements". Statements in this press release which are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, expectations or intentions regarding the future. Actual results could differ from those projected in any forward-looking statements due to numerous factors. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Although the Company believes that the plans, expectations and intentions contained in this press release are reasonable, there can be no assurance that they will prove to be accurate.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Related news releases.