NEWS RELEASE - Dieppe, NB., May 14th, 2025 - Colibri Resource Corporation (TSX.V:CBI) (OTC:CRUCF) ("Colibri" or the "Company") iwishes to announce a series of strategic corporate developments aimed at strengthening its asset base and capital structure. These include:

- Increasing its effective ownership of the Diamante Gold-Silver Project in Sonora, Mexico to 60%;

- Entering an agreement to acquire its joint venture partner's remaining interest in the project;

- Monetizing a non-core asset through the sale of its 50% interest in the Jackie Project; and

- Implementing a share consolidation to position the Company for improved capital markets access and long-term growth.

These actions align with Colibri’s sharpened focus on advancing its two most advanced exploration assets. The Company is collaborating with Tocvan Ventures on the potential future development of the Pilar Gold & Silver Project, where drilling, bulk sampling and trenching suggest near-term production potential. In parallel, Colibri is preparing for further advanced exploration activity at its 100%-owned EP Gold Project, located in a multi-million-ounce gold corridor called the Caborca Gold Belt that hosts Mexico’s largest producing gold mine owned by Fresnillo Plc called La Herradura (25km west of EP). The La Herradura, which has been operating since 1994, produced 367,000 ounces of gold in 2024 and has 7.4 milllion ounces of gold remaining in reserves at the end of 2024 (source: Fresnillo Plc - 2024 Annual Report). Colibri geologists believe that EP shares key geological characteristics with nearby gold deposits, including structure, lithology, and geochemistry—underscoring its discovery potential.

Colibri/Silver Spruce - Increases Ownership in Diamante Project to 60%

On May 10th, 2025, Colibri and its joint venture partner Silver Spruce Resources Inc. (TSXV: SSE) (“Silver Spruce”) increased their joint ownership of the Diamante Project from 50% to 60%. This increase is the result of an agreed to ownership dilution with its private Mexico based partner whereby exploration activities carried out in 2024 — including diamond drilling and fieldwork — were funded entirely by Yaque Minerales S.A. de C.V., a private Mexican company owned equally by Colibri and Silver Spruce.

In recognition of this investment, Yaque Minerales will be issued an additional 10% ownership in Bimcol Minera S.A. de C.V., the entity that holds 100% of the Diamante Project.

Colibri to Acquire Silver Spruce’s Interest in Yaque Minerales

Following the earn-in, Colibri entered into an agreement on May 12, 2025 to acquire Silver Spruce’s 50% ownership in Yaque Minerales, which will result in Colibri owning 100% of Yaque Minerales and, thereby, an effective 60% interest in the Diamante Project. Colibri will accept ownership of Silver Spruce’s shares in Yaque in lieu of an approximately $80,000 of outstanding exploration expenditures owing to Colibri, allowing Colibri to consolidate control of the project without equity dilution or additional capital expenditure.

Ian McGavney, President & CEO of Colibri, stated:

“This series of transactions advances our strategic positioning for Colibri’s future. First, by increasing and consolidating our ownership of the Diamante Project, we are enhancing our exposure to a highly prospective gold-silver asset in one of Mexico’s most productive regions. Second, we’ve done so in a non-dilutive manner. And third, this gives us flexibility to chart the Diamante’s future with greater control, which we believe will benefit shareholders.”

Drill Exploration Highlights – Diamante Project

Colibri, through its partnership in Yaque Minerales, has completed two drilling campaigns on the Diamante Gold-Silver Project since acquiring the option in 2021. These programs outlined a high-grade, multi-target epithermal system hosted in veins, breccias, and shear zones typical of the Sierra Madre mineral belt.

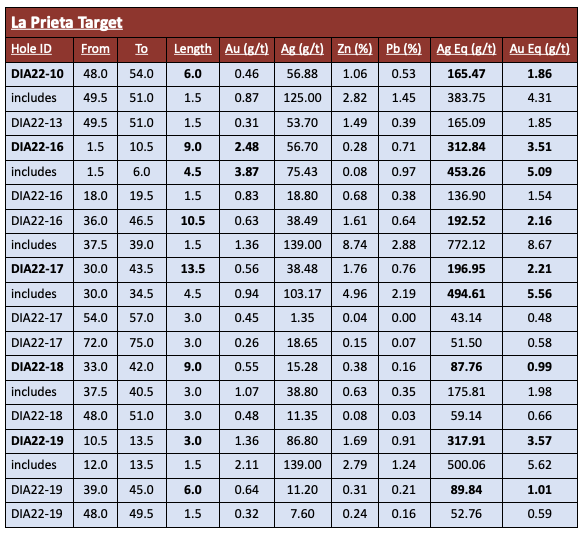

Drill results include:

*Au and Ag equivalents were calculated using metal prices of US$1660 per ounce Au, US$18.65 per ounce Ag, US$1.32 per pound Zn, and US$0.83 per pound Pb ; Lengths are intersection length. True widths are not known.

The results confirm multiple high-grade mineralized centers across the Diamante concessions and demonstrate excellent potential for discovery of new shoots and extensions. Many targets remain untested by drilling and will be prioritized in future phases.

For more information about Diamante, please see our website: http://www.colibriresource.com/diamante-project

The Diamante Gold & Silver Project is situated within the Sierra Madre volcanic sequence of Mexico and lies within a district of epithermal mineralization in Sonora that hosts many producing and historic gold, silver, and base metal mines including the La India Mine (Agnico Eagle), the Mulatos Mine (Alamos Gold), and the Santana Mine (Minera Alamos).

Colibri Divests Interest in Jackie Project

In a related transaction, Colibri has agreed to sell its 50% interest in the Jackie Project, located in Sonora, Mexico, to Silver Spruce. In exchange, Colibri will receive:

- $25,000 worth of Silver Spruce shares, and

- A 1% Net Smelter Return (NSR) royalty on any future production from the Jackie Project.

This transaction allows Colibri to monetize a non-core holding while maintaining future upside exposure through the royalty.

Share Consolidation

The Company announces that, subject to approval of the TSX Venture Exchange (the “Exchange”), it intends to complete a consolidation (the “Consolidation”) of its common shares (the “Common Shares”) on the basis of five (5) pre-Consolidation Common Shares for one (1) post-Consolidation Common Share (a “Consolidated Share”).

Currently there are 115,417,625 Common Shares issued and outstanding. On a post-Consolidation basis, the Company shall have approximately 23,083,525 Consolidation Shares issued and outstanding.

The CUSIP number of the Company will change. The Company's name and stock symbol will remain the same after the Consolidation. No fractional Shares will be issued as a result of the Consolidation. Instead, any fractional share interest of 0.5 or higher arising from the Consolidation will be rounded up to one whole Consolidation Share and any fractional share interest of less than 0.5 will be cancelled.

The Company will issue a further news release notifying shareholders as to when the effective date of the Consolidation will occur and the date on which the Company's Consolidated Shares will commence trading on the Exchange.

Pursuant to the provisions of the Business Corporations Act (British Columbia) and the Articles of the Company, the Consolidation will be approved by way of resolutions passed by the board of directors of the Company but remains subject to the approval of the Exchange.

The Company believes that the Consolidation will enhance its ability to attract new investors, improve trading liquidity, and support its broader strategic and financial initiatives.

About Colibri Resource Corporation

Colibri Resource Corporation is a Canadian-based junior gold and silver exploration company focused on high-potential projects in Sonora, Mexico. The Company holds interests in:

- The Pilar Gold & Silver Project, a joint venture with Tocvan Ventures in which Colibri owns 49%. Pilar hosts a shallow oxide gold system where surface trenching, bulk sampling, and preliminary metallurgy support near-term development potential.

- The EP Gold Project, 100%-owned and located 25 km east of Mexico’s largest open-pit gold mine, La Herradura. Drilling, surface sampling, geophysical study and mapping have identified multiple structural targets with strong geochemical anomalies.

- The Diamante Project, now 60%-owned through full ownership of Yaque Minerales. Diamante hosts extensive gold-silver and base metal epithermal systems across multiple mineralized corridors.

Colibri is committed to advancing its asset portfolio through focused exploration, development and strategic transactions that build long-term shareholder value.

Qualified Person

Jamie Lavigne, P. Geo and a Director for Colibri is a Qualified Person as defined in NI 43-101 and has reviewed and approved the technical information in this press release.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Notice Regarding Forward-Looking Statements:

This news release contains "forward-looking statements". Statements in this press release which are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, expectations or intentions regarding the future. Actual results could differ from those projected in any forward-looking statements due to numerous factors. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Although the Company believes that the plans, expectations and intentions contained in this press release are reasonable, there can be no assurance that they will prove to be accurate.

For information contact:

Ian McGavney

President, CEO and Director

Tel: (506) 383-4274

Email: ianmcgavney@colibriresource.com

Related news releases.